Navigating the process for claiming a life insurance benefit after the policyholder’s death can feel overwhelming during an already challenging time. The emotional toll of losing a loved one often complicates the practicalities involved in accessing financial support. Many beneficiaries face confusion, delays, and unforeseen obstacles, which can lead to added stress when they need peace of mind the most. To alleviate this burden, this article provides a comprehensive, step-by-step guide to navigating life insurance claims with confidence and clarity.

Understanding the Life Insurance Claims Process: An Overview

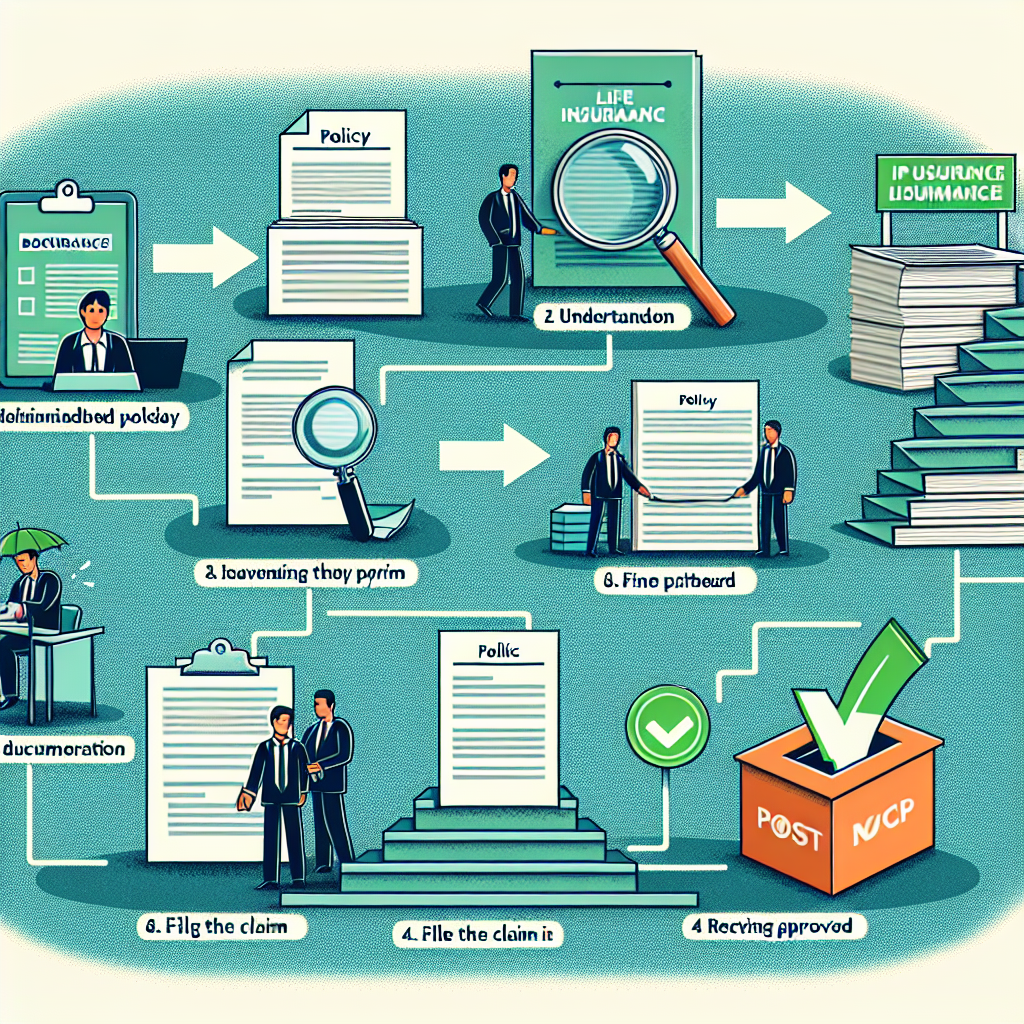

The life insurance claims process is a critical step for beneficiaries seeking to gain access to the financial benefits promised by a policyholder’s insurance coverage. Understanding this process is crucial for ensuring a smooth transition during a time of loss. Typically, the process commences with the notification of the insurer of the policyholder’s death. This often involves submitting a claim form along with essential documents, including a certified copy of the death certificate and the policy itself.

However, many beneficiaries are unaware of the finer details that could expedite their claims. Insurers often require specific types of documentation that may not be immediately obvious, leading to potential delays. For example, if the policy was issued under a different name, beneficiaries might need additional proof of identity or marriage. By gathering these documents early, claimants can navigate the process with greater ease and efficiency.

Moreover, understanding the insurer’s timeline for processing claims can also mitigate frustration. Most insurance companies will aim to settle a claim within 30 days; however, this can vary based on the complexity of the case or if additional investigation is required. It’s essential for beneficiaries to remain proactive and maintain communication with the insurer throughout this period to ensure minimal delays and to address any unforeseen issues immediately.

Essential Steps to Effectively File Your Life Insurance Claim

To effectively file a life insurance claim, the first step is to obtain and review the policy documents. Knowing the type of policy (term or whole life) and its specific terms and conditions is essential. Each policy may have unique clauses, such as contestability periods, that can impact the claims process. Familiarizing oneself with these details not only prepares beneficiaries for discussions with the insurer but also helps to identify any potential complications ahead of time.

Next, beneficiaries should prepare the necessary documentation to submit with the claim. This typically includes a completed claim form, a certified death certificate, and any other documents requested by the insurer. It’s advisable to keep copies of all submitted documents, as this can serve as a valuable reference and safeguard against miscommunication. Some insurers might also require additional items, such as medical records or information on the policyholder’s health at the time of death, which can further complicate claims.

Finally, maintaining open lines of communication with the insurance company is paramount. Designating a specific point of contact within the insurer, if possible, can streamline the process and ensure that all questions and concerns are addressed promptly. Regularly following up on the claim status can also help beneficiaries stay informed and engaged, which is essential for navigating any unexpected delays or requirements that arise during the process.

Successfully navigating the claims process for life insurance benefits requires a combination of preparedness, understanding of the requirements, and proactive communication. By following these essential steps, beneficiaries can alleviate some of the burdens associated with the claims process, allowing them to focus on healing and honoring their loved one’s memory. If you find yourself needing assistance or have further questions, reach out to your insurance provider or consult with an expert to ensure you understand your rights and options fully. Remember, knowledge is power, and being informed is the best strategy for securing the benefits you deserve.

Understanding Home Insurance Requirements Across CanadaUnderstanding Home Insurance: What Coverage Do You Need?Understanding Reasons for Car Insurance Claim DenialsRelevant LinkRelevant LinkRelevant LinkUnderstanding Canada’s Insurance Bank: A Comprehensive GuideUnderstanding Insurance Broker Salaries in Canada: A GuideUnderstanding Canada’s Insurance Coverage for Breast PumpsRelevant LinkRelevant LinkRelevant LinkUnderstanding Canada Travel Insurance for Pre-Existing ConditionsAffordable Visitor Health Insurance Options in Canada ExploredExploring Canada’s Leading Insurance Companies: A Comprehensive GuideRelevant LinkRelevant LinkRelevant Link