===

Navigating the intricate world of life insurance can be overwhelming, particularly when it comes to choosing between term and whole life insurance. What are the differences between term and whole life insurance? Understanding these distinctions is crucial for securing your financial future and protecting your loved ones. Selecting the wrong type of policy may not only lead you to underinsure your family but could also drain your financial resources unnecessarily. In this article, we’ll demystify the essential differences between these two prevalent types of life insurance to empower you to make an informed decision.

Understanding the Basics of Term and Whole Life Insurance

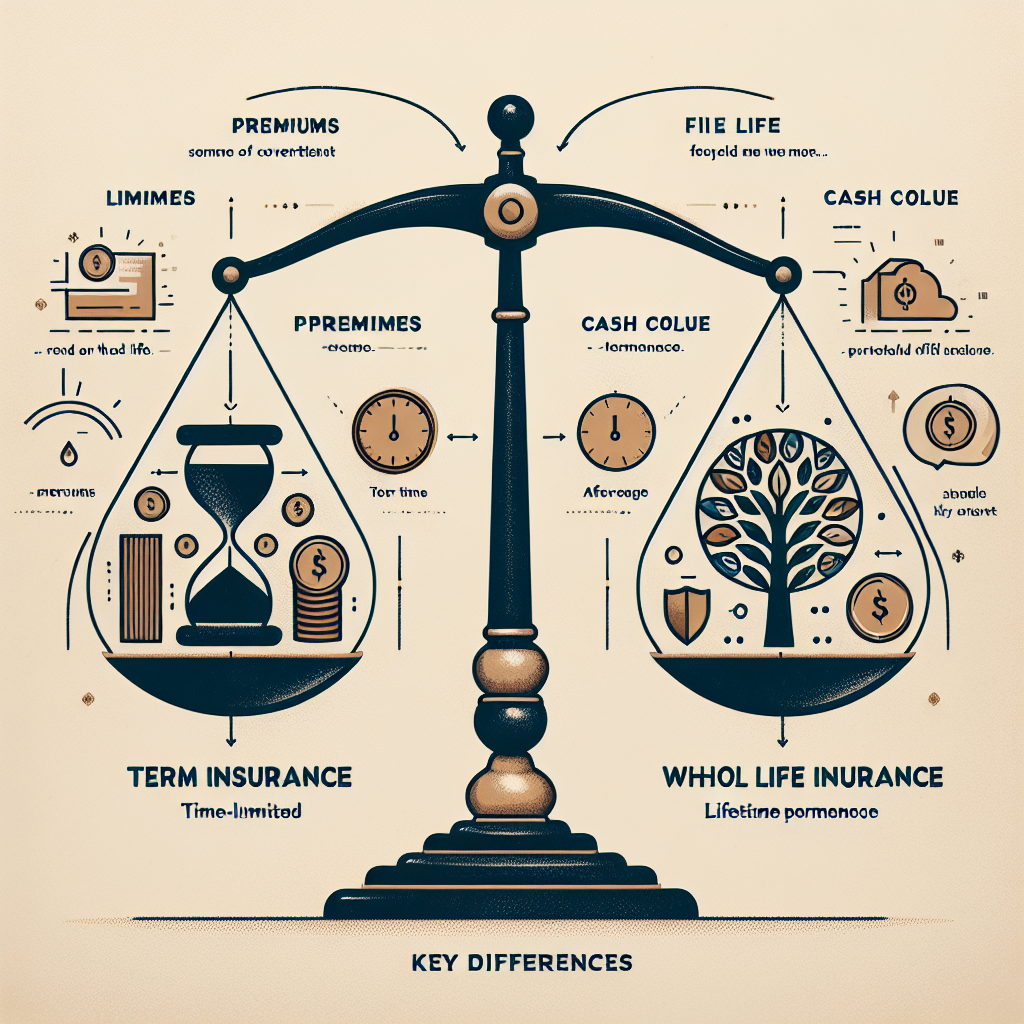

To grasp the distinctions between term and whole life insurance, it’s essential to understand their fundamental characteristics. Term life insurance provides coverage for a specified period—typically 10, 20, or 30 years—meaning your beneficiaries will receive a death benefit if you pass away within that term. Conversely, whole life insurance, a type of permanent life insurance, offers coverage for your entire life, as long as the premiums are paid. This type of policy also builds cash value over time, allowing policyholders to borrow against it or withdraw funds if needed.

The financial implications of these two policies vary significantly. Term life insurance is generally more affordable since it only covers a specific timeframe and does not accumulate cash value. This makes it an attractive option for young families or individuals seeking budget-friendly coverage. On the other hand, whole life insurance comes with higher premiums, reflecting its lifelong protection and cash value accumulation. The cash value component can serve as a financial resource that grows over time, a feature not available with term policies.

Moreover, the flexibility in managing these policies is another crucial aspect. Term life insurance typically doesn’t allow for adjustments once the policy is issued, meaning you’re locked into the terms until the policy expires. In contrast, whole life insurance may offer options for policyholders to adjust premiums or alter the death benefit as their financial circumstances evolve. Understanding these basic features can provide a solid foundation for comparing the two types of policies effectively.

Key Differences Between Term and Whole Life Policies Explained

When it comes to premium costs, the differences are stark. Term life insurance often boasts significantly lower premiums compared to whole life policies, making it a popular choice for budget-conscious individuals. The affordability of term policies allows families to invest in higher coverage amounts, providing a safety net during critical years, such as raising children or paying off a mortgage. In contrast, whole life premiums reflect the policy’s lifelong coverage and cash value benefits, often deterring those who may not need such extensive coverage.

The duration of coverage is another prominent distinction. Term life insurance is designed for specific life stages—such as during child-rearing years or while paying off debt—whereas whole life insurance is built for the long haul. This aspect of whole life policies provides peace of mind, ensuring that your beneficiaries will receive a death benefit no matter when you pass away. For those who prioritize long-term security and wealth transfer, whole life insurance may align more closely with their financial goals.

Lastly, the cash value component of whole life insurance introduces another layer of complexity. Unlike term policies, where the premiums are purely for protection, whole life policies accumulate cash value over time, offering a potential source of funds for emergencies or opportunities. This cash value grows at a guaranteed rate and can serve as a form of savings, albeit with specific limitations on withdrawals. Understanding how this works can influence your decision-making process, especially if you are looking for insurance that doubles as an investment.

===

Understanding the differences between term and whole life insurance is vital for anyone considering life insurance as part of their financial strategy. Each type comes with its own set of advantages and disadvantages tailored to diverse needs and circumstances. From cost-effectiveness to long-term security and cash value growth, the right choice depends on your individual financial goals and family obligations. As you weigh your options, remember that a well-informed decision not only protects your family but also maximizes your financial resources. If you’re ready to explore your life insurance options further or have questions, don’t hesitate to reach out to a trusted insurance advisor for personalized guidance.

Understanding Home Insurance Requirements Across CanadaUnderstanding Home Insurance: What Coverage Do You Need?Understanding Reasons for Car Insurance Claim DenialsRelevant LinkRelevant LinkRelevant LinkUnderstanding Canada’s Insurance Bank: A Comprehensive GuideUnderstanding Insurance Broker Salaries in Canada: A GuideUnderstanding Canada’s Insurance Coverage for Breast PumpsRelevant LinkRelevant LinkRelevant LinkUnderstanding Canada Travel Insurance for Pre-Existing ConditionsAffordable Visitor Health Insurance Options in Canada ExploredExploring Canada’s Leading Insurance Companies: A Comprehensive GuideRelevant LinkRelevant LinkRelevant Link