Understanding life insurance licensing in Ontario, Canada, is crucial for anyone looking to enter the financial services field. Many aspiring agents face confusion and obstacles in navigating this complex landscape. With the right knowledge, you can streamline your path to success and ensure you remain compliant while providing valuable service to clients. This article will illuminate the essentials of life insurance licensing in Ontario and guide you through the necessary steps to obtain your license efficiently.

The Essentials of Life Insurance Licensing in Ontario

Life insurance licensing in Ontario serves as a protective measure for consumers, ensuring that individuals providing insurance advice and products meet specific standards of knowledge and ethics. The Financial Services Regulatory Authority of Ontario (FSRA) oversees the licensing process, which is designed to maintain high industry standards and promote public confidence in the insurance sector. By understanding this regulatory framework, aspiring agents can better appreciate the importance of their role in safeguarding consumers and fostering trust.

In addition to regulatory oversight, life insurance licensing in Ontario requires an understanding of the various types of insurance products available, as well as the legal and ethical obligations involved in selling them. Agents must be familiar with life insurance policies, including term, whole life, and universal life insurance, along with policy exclusions and riders. This foundational knowledge is critical not only for passing the licensing exam but also for effectively advising clients on their insurance needs, ensuring they make informed decisions that align with their financial goals.

Another crucial aspect of life insurance licensing in Ontario is the continuing education requirements mandated by the FSRA. Licensed agents must complete specific courses and training sessions periodically to maintain their licenses. This commitment to ongoing education reflects the rapidly evolving nature of the insurance industry, as new products, regulations, and market trends emerge. By staying updated on industry changes and enhancing their expertise, agents can better serve their clients and ensure their practice remains competitive.

Steps to Obtain Your Life Insurance License in Ontario

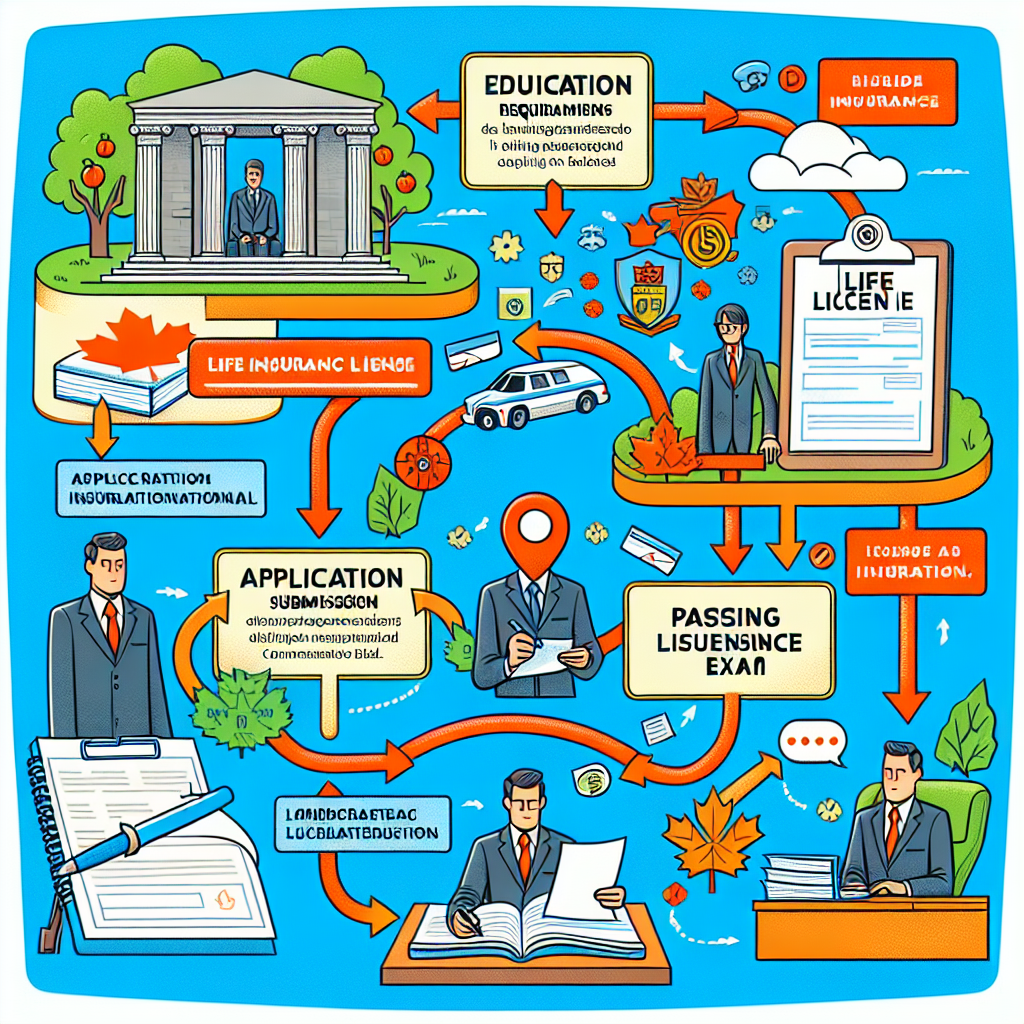

The first step in obtaining your life insurance license in Ontario is to complete a pre-licensing education program approved by the FSRA. These programs cover essential topics such as insurance fundamentals, regulations, and ethical considerations, preparing you for the licensing exam. Several institutions offer comprehensive courses, ranging from online platforms to in-person classes. Choosing the right program that fits your learning style and schedule is vital, as this foundational knowledge is critical for success in the subsequent steps.

Once you have completed your pre-licensing education, the next step is to register for the licensing exam. The exam is administered by an approved examination provider and tests your knowledge of insurance principles, products, and regulations. Preparing for this exam requires diligent study and practice, as a passing score is necessary to proceed in the licensing process. Many candidates find it beneficial to engage in study groups or utilize exam preparation resources, such as practice tests or review courses, to ensure they are well-prepared.

After successfully passing the licensing exam, the final step involves submitting your application to the FSRA along with the required fees. The application process requires you to provide proof of your education, exam results, and any necessary background checks. Once your application is approved, you will receive your life insurance license, allowing you to begin your career as a licensed life insurance agent in Ontario. Remember that maintaining your license involves fulfilling ongoing education requirements and adhering to industry regulations, ensuring you remain a knowledgeable and ethical professional in the field.

Navigating the life insurance licensing process in Ontario may seem daunting, but with the right insights and preparation, you can effectively overcome the challenges ahead. By understanding the essentials and following the outlined steps, you’ll position yourself as a well-informed insurance agent ready to serve clients with confidence. For those eager to embark on this rewarding career path, take action today by enrolling in a pre-licensing program and setting your sights on success in the insurance industry.

Understanding Canada Travel Insurance for Pre-Existing ConditionsAffordable Visitor Health Insurance Options in Canada ExploredExploring Canada’s Leading Insurance Companies: A Comprehensive GuideRelevant LinkRelevant LinkRelevant Link